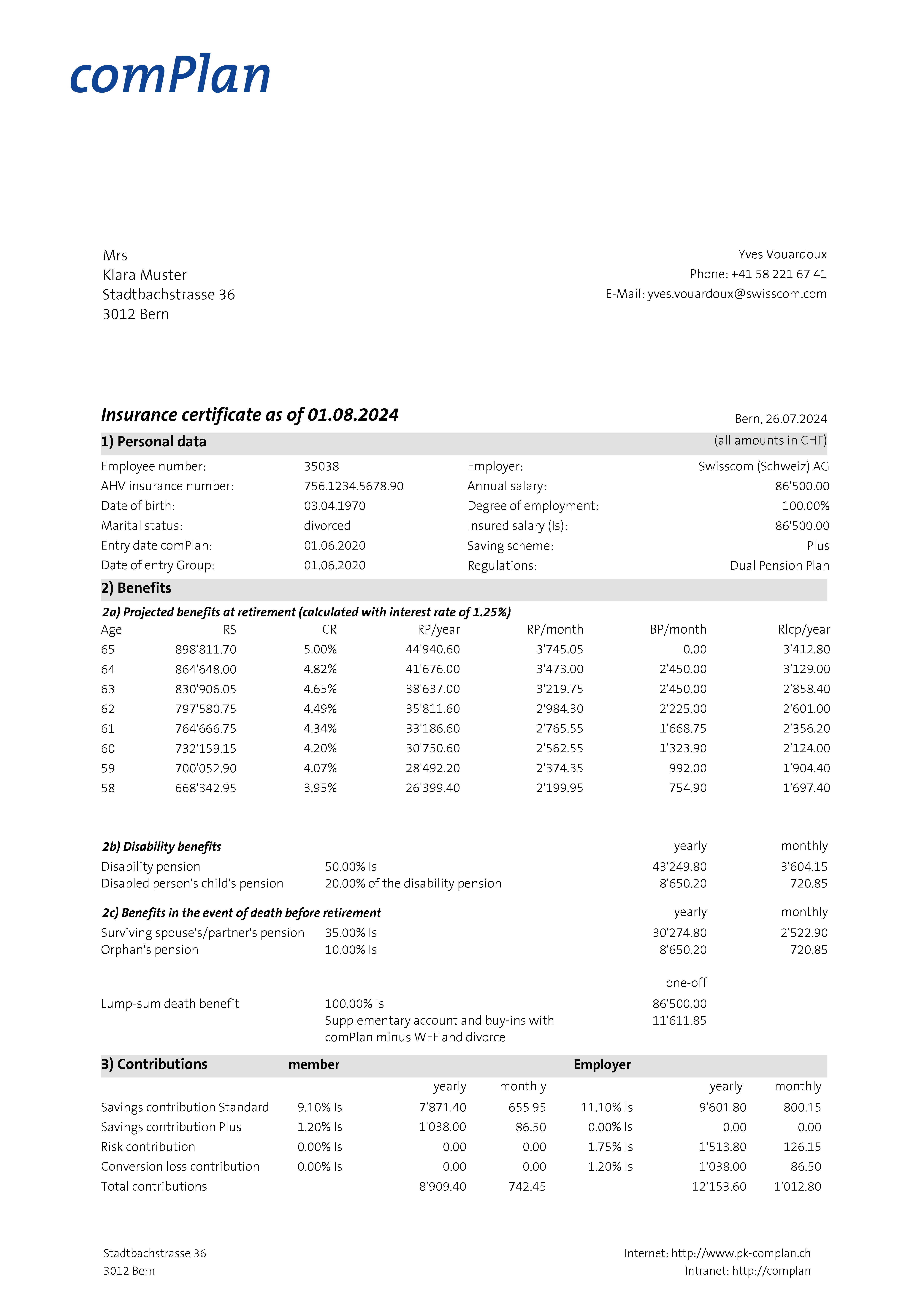

Pension statement as at: All calculations are calculated as at the date shown in the title.

Pension statement as at: All calculations are calculated as at the date shown in the title.

With comPlan, the insured salary (is) corresponds to the AHV annual salary (gross salary).

With comPlan, the insured salary (is) corresponds to the AHV annual salary (gross salary).

Projected benefits on retirement

The projected assets and benefits shown are calculated on the basis of the current values (insured salary, BVG minimum interest rate, conversion rate and existing retirement assets)

Projected benefits on retirement

The projected assets and benefits shown are calculated on the basis of the current values (insured salary, BVG minimum interest rate, conversion rate and existing retirement assets)

RS: Retirement assets

CR: Conversion rate

RP/year: Retirement pension per year

RP/month: pension per month

BP/month: AHV bridging per month

Rlcp/year: Retirement child's pension per year

RS: Retirement assets

CR: Conversion rate

RP/year: Retirement pension per year

RP/month: pension per month

BP/month: AHV bridging per month

Rlcp/year: Retirement child's pension per year

AHV bridging pension: In the event of early retirement, the employer provides a one-off amount of CHF 80,100 to finance the AHV bridging pension if the employee works 100% and has been employed by the Swisscom Group for at least 10 years. The amount is reduced by 1/120 for each month of absence. The corresponding amount for early retirement is shown in this column.

AHV bridging pension: In the event of early retirement, the employer provides a one-off amount of CHF 80,100 to finance the AHV bridging pension if the employee works 100% and has been employed by the Swisscom Group for at least 10 years. The amount is reduced by 1/120 for each month of absence. The corresponding amount for early retirement is shown in this column.

Disability benefits: The disability pension is determined according to the degree of disability. The pension shown here corresponds to 100% disability.

Disability child's pension: This is additionally paid to the disability pensioner for each child up to the age of 18. If the child is still in education or is at least 70% disabled, the entitlement continues until the child reaches the age of 25.

Disability benefits: The disability pension is determined according to the degree of disability. The pension shown here corresponds to 100% disability.

Disability child's pension: This is additionally paid to the disability pensioner for each child up to the age of 18. If the child is still in education or is at least 70% disabled, the entitlement continues until the child reaches the age of 25.

Death benefits:

Spouse's/life partner's pension: If an insured person dies, the surviving spouse/life partner is entitled to a spouse's/life partner's pension if he/she is responsible for the maintenance of one or more children or has reached the age of 40 and was married to the deceased person for at least 5 years or lived together continuously in the same household (with the same official place of residence) and had a mutual written support agreement. Entitlement to a partner's pension only exists if the partnership is documented by a mutual support agreement. This must be submitted to comPlan before death and before retirement.

Orphan's pension: This is paid until the child reaches the age of 18. If the child is still in education or is at least 70% disabled, the entitlement continues until the child reaches the age of 25

Death benefits:

Spouse's/life partner's pension: If an insured person dies, the surviving spouse/life partner is entitled to a spouse's/life partner's pension if he/she is responsible for the maintenance of one or more children or has reached the age of 40 and was married to the deceased person for at least 5 years or lived together continuously in the same household (with the same official place of residence) and had a mutual written support agreement. Entitlement to a partner's pension only exists if the partnership is documented by a mutual support agreement. This must be submitted to comPlan before death and before retirement.

Orphan's pension: This is paid until the child reaches the age of 18. If the child is still in education or is at least 70% disabled, the entitlement continues until the child reaches the age of 25

Lump-sum death benefit: The surviving dependants are entitled to a lump-sum death benefit, irrespective of inheritance law, according to the following final order of priority:

a the spouse with entitlement to a spouse's pension; in their absence

b the partner with entitlement to a partner's pension or persons who were supported to a significant extent by the insured person (excluding divorced spouses); in their absence

c all children of the deceased, in their absence the parents, in their absence the

siblings. The entitlement to a lump-sum death benefit and/or an additional lump-sum death benefit varies depending on the order of priority. Detailed information can be found in the regulations.

Lump-sum death benefit: The surviving dependants are entitled to a lump-sum death benefit, irrespective of inheritance law, according to the following final order of priority:

a the spouse with entitlement to a spouse's pension; in their absence

b the partner with entitlement to a partner's pension or persons who were supported to a significant extent by the insured person (excluding divorced spouses); in their absence

c all children of the deceased, in their absence the parents, in their absence the

siblings. The entitlement to a lump-sum death benefit and/or an additional lump-sum death benefit varies depending on the order of priority. Detailed information can be found in the regulations.

Contributions: Choose between the "Standard", "Plus" or "Extra" savings options when you join or at the beginning of each year. Further information can be found in the pension fund regulations.

Contributions: Choose between the "Standard", "Plus" or "Extra" savings options when you join or at the beginning of each year. Further information can be found in the pension fund regulations.

Savings contributions: With "Standard" savings contributions, the employer pays at least the same level of savings contributions as the employee. The contribution amount is staggered according to age categories; details can be found in the pension fund regulations.

The employee has the choice of paying in additional higher savings contributions in the "Plus" and "Extra" categories and thus saving more capital.

Risk contributions: The risk contributions are paid in full by the employer and are used to finance death and disability benefits.

The conversion rate loss contribution is also financed exclusively by the employer.

Savings contributions: With "Standard" savings contributions, the employer pays at least the same level of savings contributions as the employee. The contribution amount is staggered according to age categories; details can be found in the pension fund regulations.

The employee has the choice of paying in additional higher savings contributions in the "Plus" and "Extra" categories and thus saving more capital.

Risk contributions: The risk contributions are paid in full by the employer and are used to finance death and disability benefits.

The conversion rate loss contribution is also financed exclusively by the employer.

Account movements: The transactions carried out during the calendar year are shown in this section so that the details of the change in retirement assets can be tracked.

Account movements: The transactions carried out during the calendar year are shown in this section so that the details of the change in retirement assets can be tracked.

Standard: The standard savings contributions and asset movements are managed here.

Additional savings: Management of savings contributions for the Plus and Extra savings variants.

VP account: Management of purchases for early retirement.

Standard: The standard savings contributions and asset movements are managed here.

Additional savings: Management of savings contributions for the Plus and Extra savings variants.

VP account: Management of purchases for early retirement.

General information: In addition to general information about your retirement assets, you will find an overview of your individual additional options or withdrawals here.

General information: In addition to general information about your retirement assets, you will find an overview of your individual additional options or withdrawals here.

BVG retirement assets: The difference to the regulatory retirement assets shows the benefit level of comPlan compared to the minimum statutory provisions.

BVG retirement assets: The difference to the regulatory retirement assets shows the benefit level of comPlan compared to the minimum statutory provisions.

Maximum purchase amount for the ordinary benefits: This value corresponds to the difference between the maximum possible retirement assets minus the actual available assets.

Maximum purchase amount for the ordinary benefits: This value corresponds to the difference between the maximum possible retirement assets minus the actual available assets.

Support and life partner contract: If a contract has already been submitted, the relevant information can be found here.

Support and life partner contract: If a contract has already been submitted, the relevant information can be found here.

Maximum possible early withdrawal for home ownership: The current retirement assets (= termination benefit) are available for financing home ownership up to the age of 50. If you are over the age of 50, you may withdraw at most the greater of the following amounts:

- termination benefit at age 50 or

- 50% of the termination benefit at the time of the early withdrawal.

The minimum amount for the early withdrawal is CHF 20,000.

Further provisions and information on the promotion of home ownership can be found in the separate brochure.

Balance of completed early withdrawal for home ownership: Once an early withdrawal has been made, there is no possibility of a further early withdrawal until a period of 5 years has elapsed. In addition, an early withdrawal can only be made up to 3 years before the reference age. This deadline must also be adhered to in the case of early retirement.

Maximum possible early withdrawal for home ownership: The current retirement assets (= termination benefit) are available for financing home ownership up to the age of 50. If you are over the age of 50, you may withdraw at most the greater of the following amounts:

- termination benefit at age 50 or

- 50% of the termination benefit at the time of the early withdrawal.

The minimum amount for the early withdrawal is CHF 20,000.

Further provisions and information on the promotion of home ownership can be found in the separate brochure.

Balance of completed early withdrawal for home ownership: Once an early withdrawal has been made, there is no possibility of a further early withdrawal until a period of 5 years has elapsed. In addition, an early withdrawal can only be made up to 3 years before the reference age. This deadline must also be adhered to in the case of early retirement.